Navigating the world of government assistance can be tricky, especially when you’re a single parent trying to provide for a large family. One of the most important programs for low-income families in the United States is the Supplemental Nutrition Assistance Program, or SNAP. This essay will delve into the details of how SNAP works, and specifically, address the question of how much a single mother with five children might receive in food assistance.

Understanding the Basics of SNAP Benefits

So, how much money does a single mom with five kids get from SNAP? The amount of SNAP benefits a family receives isn’t a fixed number; it depends on several factors, but a major component is household size. The U.S. Department of Agriculture (USDA), which oversees SNAP, updates its benefit amounts each year to adjust for the cost of food and the Consumer Price Index (CPI). These updates ensure that the benefits keep pace with inflation. Other factors, like income and certain expenses, also play a role in the final amount.

Household Size and SNAP Eligibility

The most important factor in determining SNAP benefits is the size of the household. SNAP is designed to help families purchase groceries, so the larger the family, the more assistance they typically receive. For a single mother with five children, the household size is six (the mother plus five kids). This means the benefit amount calculation starts with the maximum allotment for a family of six.

Income also plays a significant role. SNAP has income limits, both gross and net income limits. Gross income is the total income before deductions, like taxes. Net income is income after certain deductions are taken out. These deductions may include things like child care expenses, medical expenses for the elderly or disabled, and shelter costs.

Here’s how to understand how household size affects benefits:

- A single person household receives the least amount.

- Each additional person in the household increases the benefit amount.

- The maximum benefit amount is calculated based on household size.

It’s important to remember that income and the cost of living can vary greatly across the United States, affecting the benefit amounts in different states.

Income Limits and How They Affect SNAP Benefits

Income limits are another crucial part of SNAP eligibility. Each state has its own income limits, which are based on the federal poverty guidelines. Generally, a family’s gross monthly income must be at or below a certain level to qualify for SNAP. The net monthly income (after deductions) must also be below a certain threshold.

These limits change each year, so it’s important to check the most current information for your state. A single mother with five children would need to make sure her income falls below these limits to be eligible for SNAP.

What are the income limits used to determine SNAP eligibility?

- Federal Poverty Guidelines: These guidelines set the baseline for income limits.

- State-Specific Variations: States can adjust income limits, making them unique to their needs.

- Gross vs. Net Income: Both are considered, with net income being the income after deductions.

- Income Verification: Proof of income is required.

Keep in mind that there are specific rules for self-employment income and how it’s calculated as well.

Deductions That Can Increase SNAP Benefits

Certain expenses can be deducted from a household’s gross income to determine the net income. These deductions can significantly increase the amount of SNAP benefits a family receives because a lower net income means the family may be more eligible for more benefits. Examples of common deductions include housing costs, childcare expenses (if the mother is working or in school), and medical expenses for the elderly or disabled.

Here is an example showing how deductions help a family to receive SNAP:

| Expense | Amount |

|---|---|

| Gross Monthly Income | $3,000 |

| Childcare Expenses | $500 |

| Rent | $1,000 |

| Net Monthly Income | $1,500 |

It’s important to provide documentation to support these deductions. The more deductions a family can claim, the lower their net income, and potentially the more SNAP assistance they receive.

State-Specific SNAP Benefits

While the federal government sets the basic guidelines for SNAP, each state is responsible for administering the program. This means that the actual benefit amounts can vary slightly from state to state. The cost of living, availability of resources, and state policies all play a role in determining the specific benefits.

Because SNAP is administered by the states, the benefits will differ across the nation.

- State’s Cost of Living: States with higher costs of living may offer higher SNAP benefits.

- State Policies: Each state sets its own specific rules and regulations regarding SNAP.

- Online Resources: Look up your state’s SNAP website for more information.

- Check for Updates: Benefit amounts are updated periodically to meet the local needs.

Therefore, a single mother with five children might receive a different amount of SNAP benefits in California than in Mississippi, even if their income and expenses are the same. Checking your state’s website for information is very important.

How to Apply for SNAP Benefits

The application process for SNAP typically involves completing an application form, providing proof of income and other required documentation, and participating in an interview. The application is usually submitted to your local SNAP office, which is often a part of the state’s department of social services or human services.

To start the application process, you can use these steps:

- Find Your Local SNAP Office: Your state’s website will have information.

- Fill Out an Application: The application will require information about your income, expenses, and household size.

- Submit Necessary Documents: Provide proof of income, identity, and residency.

- Complete an Interview: You might have an interview to review your application.

- Wait for a Decision: The SNAP office will let you know the status of your application.

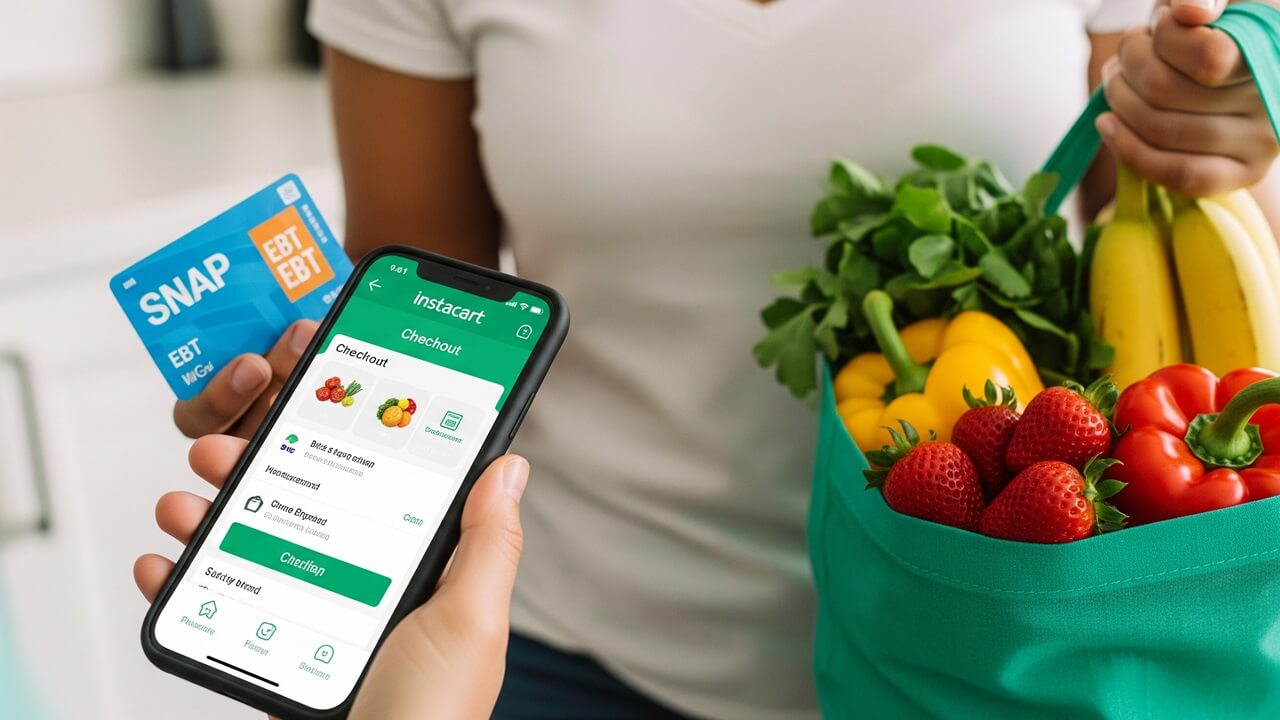

You can typically apply online, by mail, or in person. It’s important to provide accurate information and to respond promptly to any requests from the SNAP office. Once approved, benefits are usually loaded onto an Electronic Benefit Transfer (EBT) card, which can be used like a debit card at authorized retailers.

Maintaining SNAP Eligibility

Once you are approved for SNAP, it’s important to maintain your eligibility. This usually means reporting any changes in income, employment, or household size to the SNAP office. Failure to report changes could result in a reduction of benefits or even disqualification from the program.

What you should be aware of to keep your SNAP benefits:

- Reporting Changes: Always notify the SNAP office of changes in income, employment, and family status.

- Regular Reviews: SNAP benefits are reviewed periodically.

- Following the Rules: Adhere to all the guidelines of the SNAP program.

- Using Benefits Properly: Use your EBT card only for eligible food items.

SNAP is a valuable resource, and understanding the rules is essential for the program to work for those who need it.

Conclusion

In summary, while the exact amount a single mother with five children receives from SNAP depends on a number of factors, including household size, income, and deductions, the program provides vital support to families who need help to put food on the table. The best way to find out the specific benefit amount is to apply for SNAP and provide the necessary information. By understanding the eligibility requirements and the application process, families can take advantage of this important program.